Schedule a Webex meeting with Cisco’s dedicated retirement planning consultant

Here's the deal.

Many of us are balancing priorities—paying off debt or saving for a home. Loans, scholarships or financial aid may be available for some of your other goals. But you don’t have the same options for financing your retirement. So maybe the real question is: can you afford not to save?

Pay yourself first.

Would you be willing to bring your lunch to work once a week if it meant you could go out to dinner once a week in retirement? Finding additional money for your 401(k) can be as easy as packing a bag lunch, adjusting your home thermostat, or having a stay-at-home date night once a month or making coffee at home. With Cisco’s match and the potential power of compound earnings, the 401(k) is one of your most valuable savings opportunities.

Put time on your side.

The earlier you start saving, the more time your money has to potentially grow—that’s the power of compounding.

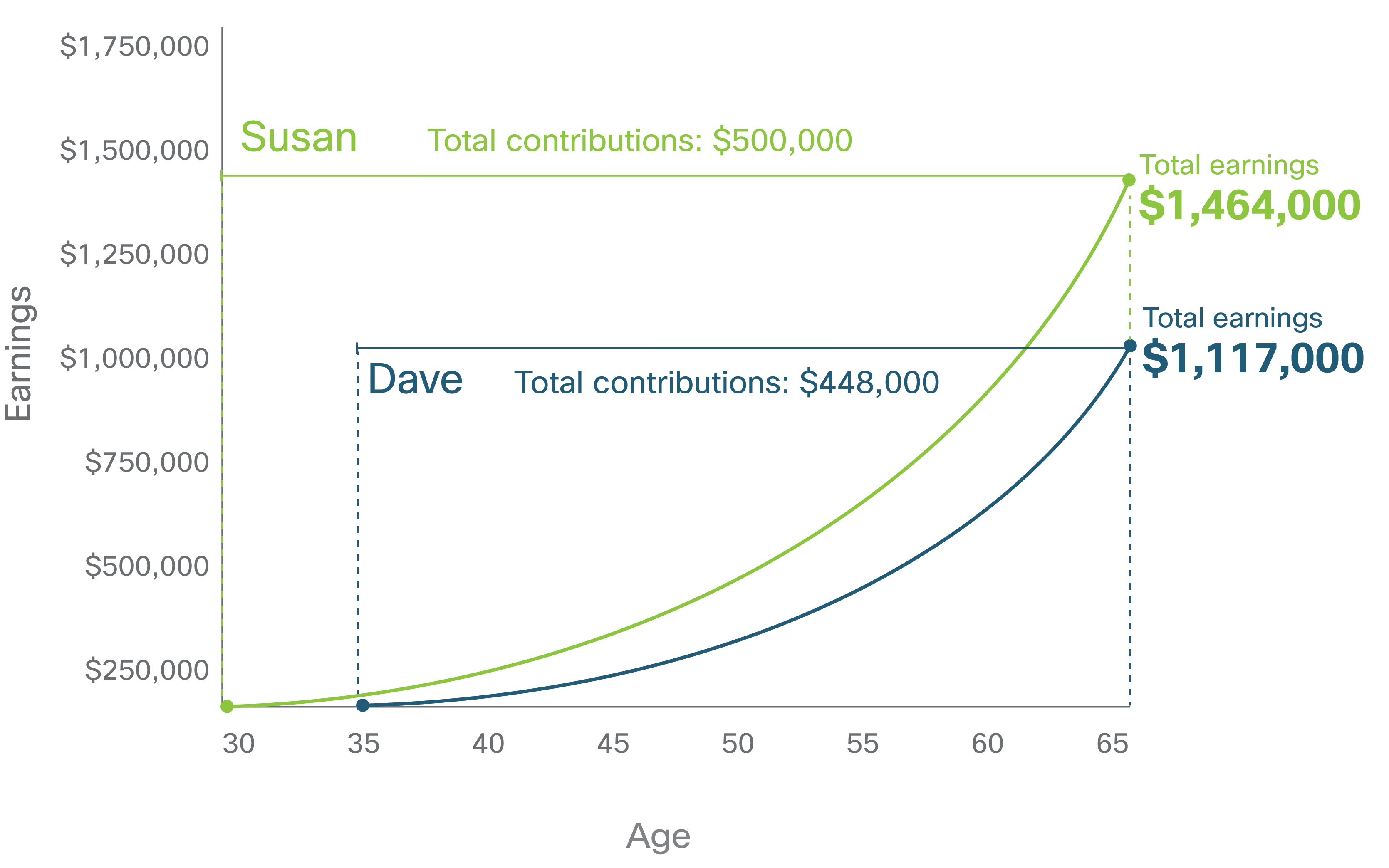

Compare Susan and Dave.

Both join Cisco at age 30, earn $100,000 annually, contribute 10% to the 401(k) until age 65 and earn the same return.

The difference? Susan starts contributing immediately, while Dave waits five years to start contributing.

So what happens when they retire? Susan only puts in $52,000 more, but has $347,000 more at 65.

This hypothetical example assumes a beginning Plan account balance of $0; annual contributions throughout the year of 10% of pay (with a 2% annual increase) starting at the age shown above until age 65 and an effective annual rate of return of 6%. Ending values do not reflect taxes, fees or inflation. If they did, amounts would be lower. Earnings and pre-tax contributions are subject to taxes when withdrawn. Distributions before age 59½ may also be subject to a 10% penalty. Contribution amounts are subject to IRS and Plan limits. Systematic investing does not ensure a profit or guarantee against a loss in a declining market. This example is for illustrative purposes only and does not represent the performance of any security. Consider your current and anticipated investment horizon when making an investment decision, as the illustration may not reflect this. The assumed rate of return used in this example is not guaranteed. Investments that have potential for a 6% annual rate of return also come with risk of loss.